Fractional CFO vs CPA: What's the Difference?

You want to ensure your business’ financials remain strong and stable and know that few things are more critical for long-term success than having a solid financial plan. But what is the best way to ensure your finances are headed in the right direction? Should you hire a CPA or opt for fractional CFO servicesinstead?

Understanding the nuances between these two roles can help you decide which option will provide the most benefit to your organization. Keep reading to learn the differences between a Fractional CFO vs CPA to hire the right professional for the work at hand.

Fractional CFO vs CPA: Let’s Get Some Things Straight

Before I dive into how these roles differ, let’s get on the same page about Certified Public Accountants (CPAs) and Chief Financial Officers (CFOs).

Can You Be a CFO Without a CPA?

A CFO does not necessarily need to hold the qualifications of a CPA. I have had a successful corporate career as a full-time CFO and never held a CPA license and know many successful corporate full-time CFOs that are not CPAs. Now I offer fractional CFO services through Brady CFO and fully support my clients without CPA qualifications.

Can a CPA Become a CFO?

A CPA can certainly be a CFO. However, when hiring for your next accounting role, it's essential to understand that just because someone is a CPA doesn’t mean they’re automatically qualified to be a CFO. Keep reading to dive deeper into the fundamental differences between a Fractional CFO vs CPA to understand why.

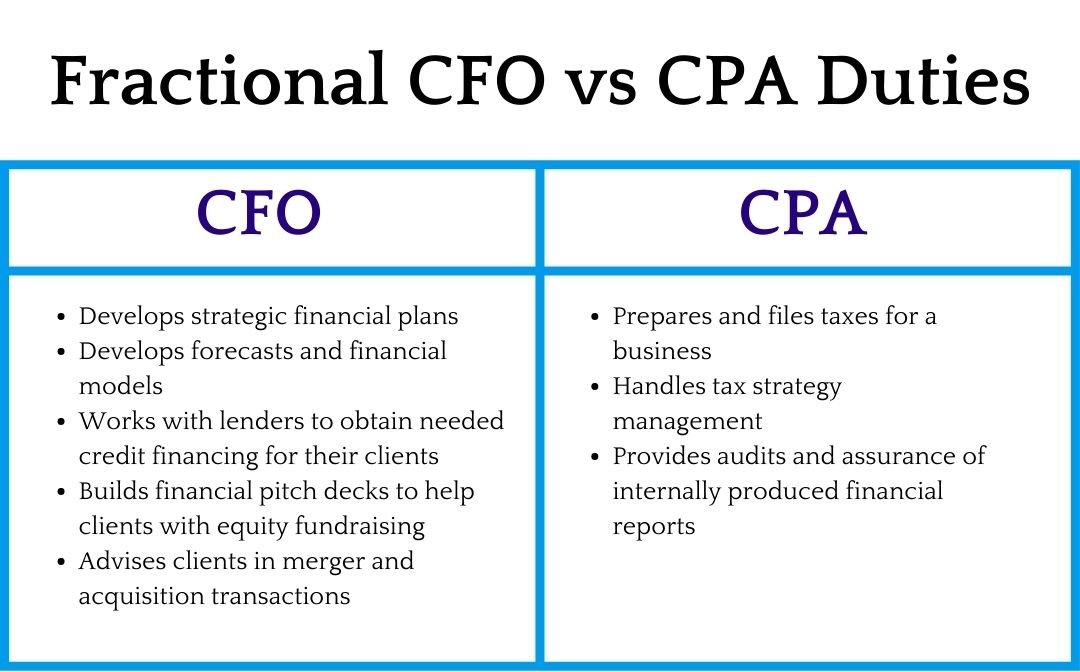

Fractional CFO vs CPA: How These Roles Differ in Daily Operations

So, what is the difference between a Fractional CFO vs CPA in the daily operations of your accounting function? It comes down to experience and services provided.

Fractional CFO Services

A Fractional CFO is an integral member of your leadership team who

Develops strategic financial plans

Develops forecasts and financial models

Works with lenders to obtain needed credit financing for their clients

Builds financial pitch decks to help clients with equity fundraising

Advises clients in merger and acquisition transactions

Ultimately, a CFO helps plan and develop the future. While accounting by trade is focused on reporting past events, a CFO uses historical financial reporting and forecasts to prepare for what’s ahead. Whether full-time or fractional, a CFO should not just be a financial advisor but should have an understanding and knowledge of other business functions as well.

At Brady CFO, I offer a holistic approach to fractional CFO services because I understand what it’s like to be in the trenches of starting and growing a business. My clients generate $1-$30 million in annual revenue in America’s backbone industries–food production, food service, warehousing and distribution, manufacturing, construction, professional service firms, etc.–and rely on me to bring real-world insights and value-driven advice to their accounting function.

Therefore, a Fractional CFO should confidently bring these qualities to the table:

Strategic planning capabilities

Leadership ability

Financial forecasting and modeling skills

Storytelling capabilities

Influence skills

Broad background experience in other functions besides finance/accounting

CPA Services

A CPA is an important member of your accounting team who provides external financial services in the following areas:

Tax preparation and filings

Tax strategy management

Audit/assurance of internally produced financial reports

While CPA license requirements vary by state, most require individuals to have multiple years of attestation experience to obtain a CPA. This means CPAs have to perform financial audits under a supervisor.

An audit is a comprehensive review of a business's accounting records and procedures. Outside of public accounting, this experience serves people in a Controller position to ensure the financial reporting and accounting are up to par. In addition, many CPAs end up working in tax–one segment of the entire financial focus of a company.

Because many CPAs have a particular tax focus, they don’t necessarily have the skill sets to help a company fundraise equity or credit. For example, suppose a company solely focuses on reducing tax liabilities for ownership. In that case, the company will show as little profit as legally possible, which is detrimental in the long run if they decide to sell the business. Investors or banks want to see a plan for solid profitability, which isn’t the goal for a CPA focused on tax.

So, What’s the Difference Between a Fractional CFO vs CPA?

Although the role of a CPA is very valuable, their expertise does not necessarily translate into knowing how to forecast and holistically plan for the future (the role of a CFO). In most cases, an outside CPA focuses on providing assurance of historical financial reports and/or submitting tax filings based on historical data, and CFO uses the historical data to develop a holistic financial plan for the future. The positions work together but aren’t one in the same.

A CPA offers a wide range of accounting and finance services, including preparing financial statements, tax planning advice, and assurance services. However, their experience alone does not suit them well for a career as a CFO. Therefore, when hiring a Fractional CFO, it’s essential to evaluate the person’s experience in developing multi-year strategic financial plans to improve profitability and cash flows and identify additional cash flows and strategic investment opportunities.

Ensure a Strong Financial Future for Your Company with Fractional Services from Brady CFO

If you know your historical financial data but need help using it to develop a plan for sustainable growth for generations, you’re in the right place. Through Brady CFO, I am the Fractional CFO to value-driven business owners with $1-$30 million in revenue who are working to do some good. Contact me todayfor a personalized assessment of your finances, and we’ll create a customized plan for your company’s financial future.